Access to information can be your prime competitive advantage—with the right information you can make informed decisions on each new opportunity or challenge—but how can you make sure you have the right data when your company’s risk management teams are disconnected from one another?

The November 2019 Deloitte Global Risk Management Survey found that risk data quality and management is a key concern for 79% of GRC respondents, but most companies are struggling to integrate their governance, risk, and compliance (GRC) teams and lack a truly integrated tech solution.

Organizations often use a number of separate GRC technology and data analytics vendors, making it difficult to share resources and information and accurately analyze data. Without a full picture of the risk factors involved, it’s tough to uncover and quickly address emerging risks and even harder to jump on potential growth opportunities.

Additionally, your GRC teams may need to rely heavily on developers and other staff that have the technical capability to automate workflows, set up integrations, and pull and analyze data. This can impact timeliness, and if your teams attempt to do this themselves without the necessary expertise, there’s a higher likelihood of errors.

All of this can lead to operational interruptions, overlooked risks, and potential compliance issues, which may lead to negative consequences for your business, such as fines and penalties.

Reducing errors and having a comprehensive view of all your risks can help you gain that competitive edge, which is why it’s important to move to an integrated risk management solution.

What is integrated risk management?

IRM refers to an approach in which risk management is integrated into each process, activity, and operation within an organization, so that everyone can understand the risk within their space. This includes logistics management, production processes, finance, HR, legal, IT, security, and marketing.

Stakeholders across the business should be able to access a real-time view of risks for every asset, system, and third-party supplier, allowing them to make informed decisions based on their risk appetite.

IRM also requires a culture that prioritizes easy access to data so that risk management teams can interpret and respond to threats quickly. By building a risk-aware company that elevates the role of risk management in every area of the organization—not just in cybersecurity or legal—you can manage threats across the business more effectively.

Why invest in integrated risk management technology?

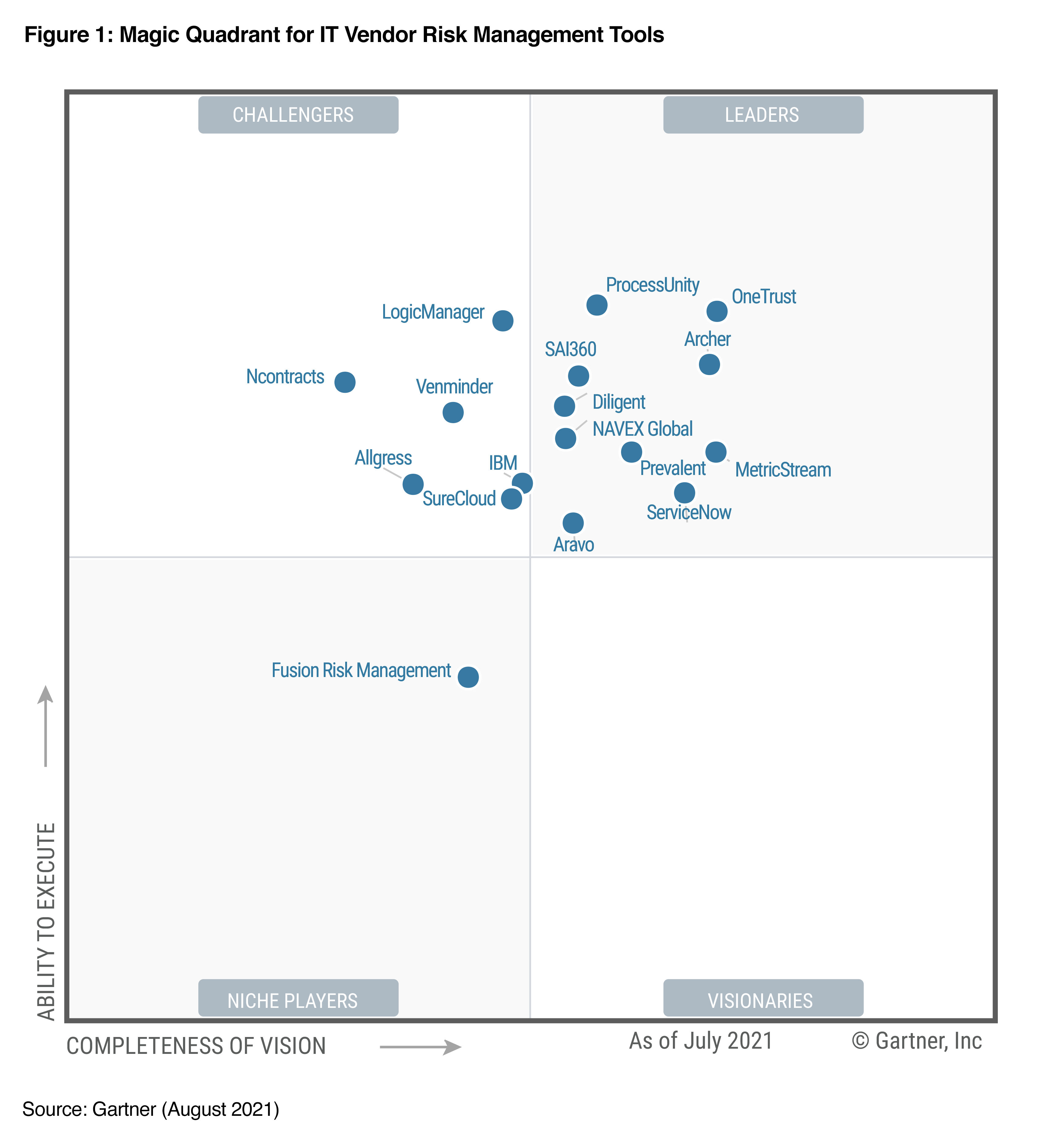

The traditional role of GRC can include a multitude of poorly integrated solutions and many manual processes that can slow your company down and increase the chances of errors or overlooked risks.

An integrated risk management platform, in contrast, is all-in-one. It’s a comprehensive solution that gives your entire GRC team the visibility and deep insights they need to understand your organizational risk, provide assurance, and quickly report to executive stakeholders for more informed, data-driven decisions.

An integrated risk management platform allows you to:

- Design automated, end-to-end workflows to meet your organization’s GRC needs and execute in real time.

With an integrated risk management solution, you can automate all of your GRC workflows and configure your risk scoring models, helping you identify risk factors quickly. This allows you to automate tasks based on set triggers and flag suspicious records to address through remediation. - Gain deep insights through advanced data analytics.

You should be able to use pre-configured robots for common GRC and IRM use cases, such as calculating the criticality score of a third party. The ability to build custom data automations within a drag-and-drop interface is a huge plus. When you’re not reliant on an engineering team for support, your GRC teams will get the answers they need faster. - Manage your data and workflow automation in one centralized location.

Your organization should be able to access one shared platform for a single source of truth for all data throughout the business. This facilitates greater collaboration and faster decision-making. - Integrate data from multiple sources for a comprehensive lens of your GRC landscape.

Your IRM solution should pull in data feeds from proprietary and third-party sources to give you a holistic picture of your organization’s risk factors and levels in real time. This will help you uncover deeper insights, such as complex cases of fraud or gaps in your control environment. - View your data in visualization storyboards and reports.

Your IRM solution should be able to report on key business metrics and drill down on data analytics with visualization storyboards. These should be customized based on the team or stakeholder, helping them better understand their risk and compliance levels for deeper strategic analysis.

By moving from a collection of siloed GRC tools and assets to an integrated risk management solution, you’ll have deep visibility into the risk factors and compliance initiatives across your organization and powerful metrics to help you make sense of everything and move forward with confidence. You’ll be able to understand issues on an individual level, as well as spot trends that affect your organization at a structural level.

With all of your data together in one place for seamless collaboration, your GRC teams can refocus their efforts. Rather than checking boxes and sticking solely to compliance tasks, they’ll be able to automate those functions and free up their time to provide true strategic support to the organization.

An integrated, agile risk management team is crucial for helping your organization stay competitive and seize the right business opportunities. By leveraging an IRM solution that brings all of your data together in one place, your GRC teams will have the insights to help your business get ahead.

eBook:

How integrated risk management makes your business more competitive

While there are many digitization strategies that can help organizations rise above the competition and increase their market share, one of the most valuable opportunities to consider is integrated risk management (IRM). In this eBook, you’ll learn:

- What IRM is and how it differs from related business frameworks

- How you can use IRM to gain a competitive edge

- What to look for in an IRM solution