Top-performing organizations are able to make better business decisions in part because of how they manage their risk. Facing risks that range from operational to third-party, financial to cybersecurity, and more, these organizations take an integrated approach.

With integrated risk management (IRM)—a strategic and collaborative way to manage risk across an organization—the whole risk management team comes together in a centralized platform to share and visualize data around risk, ensure compliance, and communicate strategy and progress to executive teams.

With better visibility into the risks they face, these top performers know what needs to be tackled first and how different scenarios will likely play out—such as opening a new office location or contracting with a new vendor. By understanding all the variables and taking quick action, they’re able to prevent risks from damaging the organization and stay ahead of their competitors.

But many organizations struggle to fully integrate their governance, risk, and compliance (GRC) functions, and still rely on a network of various vendors and technology providers. While a survey from the Trakia Journal of Sciences found that 80% of businesses say that it’s both useful and necessary to integrate risk throughout the business, most have yet to take the initiative. Only 15% of organizations have risk management integrated into all of their business processes.

Here are some simple steps you can take to move from a disconnected approach to risk to an IRM solution.

1. Assess where you are today

Audit all of the technology you’re using for your GRC functions. In order to understand what is providing genuine value to your organization, look at which tools in your tech stack are fully integrated with one another, who uses them, how often they’re used, and whether they duplicate any functions.

2. Get feedback on the limitations of your tech

Talk to members of your risk management teams to find out what they struggle to do with the solutions currently available to them—whether that’s gathering data, automating workflows, or building analytics reports.

3. Get buy-in from executive stakeholders

Once you’re aware of your shortfalls, hold a roundtable with executive stakeholders to get them on board with investing in an integrated solution. By spotlighting how IRM can make your company more competitive, you’ll be able to convince them of its value. A move to IRM means that you can change the role of risk management from being singularly focused on compliance into a true strategic partner to the rest of the organization.

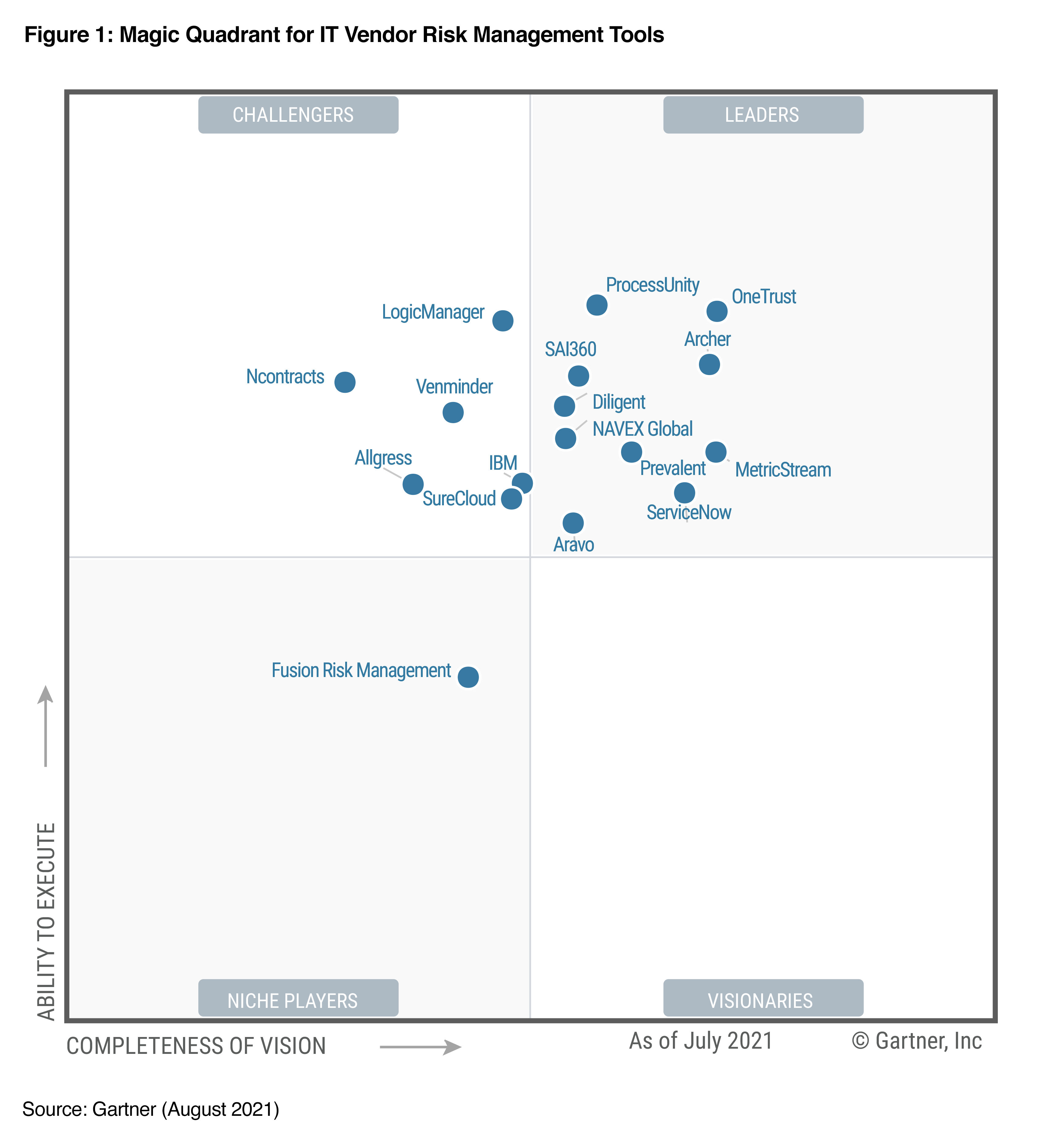

4. Evaluate IRM solutions

Once you understand where your current solutions fall short, it’s time to identify an IRM platform that can bridge those gaps and help your team become more efficient and strategic in their roles. Many standard GRC solutions don’t meet the full definition of an IRM solution, so in order to find one that qualifies, you should look for it to:

- Design automated, end-to-end workflows to meet your company’s GRC needs and execute on them immediately

- Get the answers you need quickly through advanced data analytics

- Manage your data and workflow automation in one centralized location

- Integrate data from multiple sources to get a comprehensive view of your GRC landscape

- Display your data in visualization storyboards and reports

5. Choose a solution

After evaluating multiple vendors based on criteria around company size, industry, and budget, you should have the information you need to make the right choice. Ensure that the solution you’ve chosen provides the right level of support to help you integrate all of your systems into it.

6. Inventory all of your risks

With a comprehensive overview of all of your risks now in one place, gather feedback from managers in each business unit so that you’re tracking the right risks across your organization. Your IRM solution will likely include a framework of common risks in your industry, but it’s important to map out more customized factors as well. From there, you can prioritize the risks by level of importance.

7. Identify stakeholders and have them set up action plans

Each risk factor should have an identified stakeholder responsible for monitoring that risk and managing a mitigation plan when levels are elevated. Have each stakeholder outline proper risk thresholds and provide a step-by-step action plan in the event of increased risk.

8. Set up industry-specific compliance workflows

Your IRM solution should come with pre-built compliance checklists based on your industry and its needs. Set up the compliance workflows that make sense for your business.

9. Educate and train your employees

Just because you’ve chosen a solution, doesn’t mean your employees will make the most of it—you need to prioritize education during the onboarding process. Conduct training seminars for the entire risk management function, and provide small group or one-on-one training to specific employees to help them understand their individual responsibilities for using the new system. Get everyone used to your new platform before you phase out your other tools completely.

Making the move from a network of disjointed systems and assets to an integrated risk management system isn’t without its challenges, but it’s well worth putting in the legwork to execute.

By moving to an IRM solution, you’re able to gain deep visibility into your organizational risk factors and streamline your compliance initiatives—giving your employees both the time and the visibility to focus on strategic business plans that will drive your company forward.

eBook:

How integrated risk management makes your business more competitive

While there are many digitization strategies that can help organizations rise above the competition and increase their market share, one of the most valuable opportunities to consider is integrated risk management (IRM). In this eBook, you’ll learn:

- What IRM is and how it differs from related business frameworks

- How you can use IRM to gain a competitive edge

- What to look for in an IRM solution