Thinking of introducing RPA in your organization? We look at four critical steps toward a successful implementation.

In part one of this two-part series, we looked at how robotic process automation (RPA) can benefit finance teams and identified common processes that are perfect for automation. Now we’ll dig into some practical considerations when beginning your RPA journey.

Introducing RPA begins with change management

People are, by nature, resistant to change, and many will be suspicious of RPA and how it will impact their roles. So, the very first thing you need is a solid change management strategy to reduce this resistance. You’ll also want to develop a proactive communication plan that addresses concerns and facilitates open, ongoing communication throughout all stages of implementation.

Let’s explore some key areas to focus on when implementing RPA:

Secure senior management buy-in

The first thing you’ll want to do is get executive buy-in and share it with the rest of your team. It’s critical to get management onboard with your RPA vision and make sure they’re aware of the long-term benefits—especially if there’s any short-term disruption to the finance team.

Depending on your team and organization’s size, this might involve a quick discussion or a formal presentation, but you’ll need to clearly communicate the intended outcomes, budget or staffing impacts, and projected ROI on new technologies. And don’t forget to include a well-thought-out argument on any process changes needed to implement RPA. Involving IT and any other business area sponsors is essential in the success of this phase.

Access quality data

RPA is only as good as the quality of your data. And your data needs to be clean, reconcilable, and working in line with an appropriate data management strategy, otherwise no matter how hard you try, implementing RPA just isn’t going to be successful.

Getting quality data might not seem like a significant challenge at first, because finance teams are no strangers to accessing and using data in accounting and other systems. But in practice, the data requirements for some forms of RPA are totally different than what you need for those typical accounting processes.

For example, if you want to automatically analyze and monitor all payment transactions for control breakdowns, you’ll need to compare data from many different data sources. This could include:

- Scheduling automated downloads of data from finance systems like vendor purchase orders and payments, corporate credit cards, and travel and entertainment expenses.

- Connecting to other sources of business data like human resources and network and physical access logs.

The bottom line is that you need to create the procedures to regularly produce the right datasets at the right time, with minimal manual activities. And, just like every other step, consider any other business area (information technology, information security, legal) that might need to be involved or provide approvals for this data access.

Have the right skill sets

When you implement RPA, your finance team will experience an inevitable shift in required skill sets. Since manual data entry and testing is now in the hands of robots, your team gets to refocus on value-adding activities. This could mean new training for certain employees or shifts in role priorities.You’ll want to work with HR to identify training, role changes and budgets needed to manage the transition and mitigate personnel impacts.

Identifying (or hiring) team members who understand the basics of data analysis apps and automation should be on your to-do list. You’ll need people who can assess existing manual procedures, like account reconciliation, and shift these to optimized automated processes. Experienced consultants can also help you with your roll-out and any necessary upskilling.

“The bottom line is that you need to create the procedures to regularly produce the right datasets at the right time, with minimal manual activities.”

And, just like every other step, consider any other business area (information technology, information security, legal) that might need to be involved or provide approvals for this data access.

Introducing RPA starts with change management.

Four critical steps toward successful RPA implementation

The process doesn’t stop there. To make sure you successfully implement your RPA, we’ve put together a few key steps:

1. Determine your automation goals

You’ll first want to define clear goals and make sure people, processes, strategy, and technology are aligned. Do you want automation with minimal effort and investment? Or are you looking to implement a more comprehensive team-wide automation program? The outcome of this decision will determine your solution options and implementation planning.

2. Plan the RPA roadmap

When you consider automation, be sure to look beyond its initial deployment and set out how it will grow across your organization. Start slowly with simple processes to build momentum and demonstrate value. Then scale to support more complex business areas. Successful RPA implementations should result in long-term strategic gains.

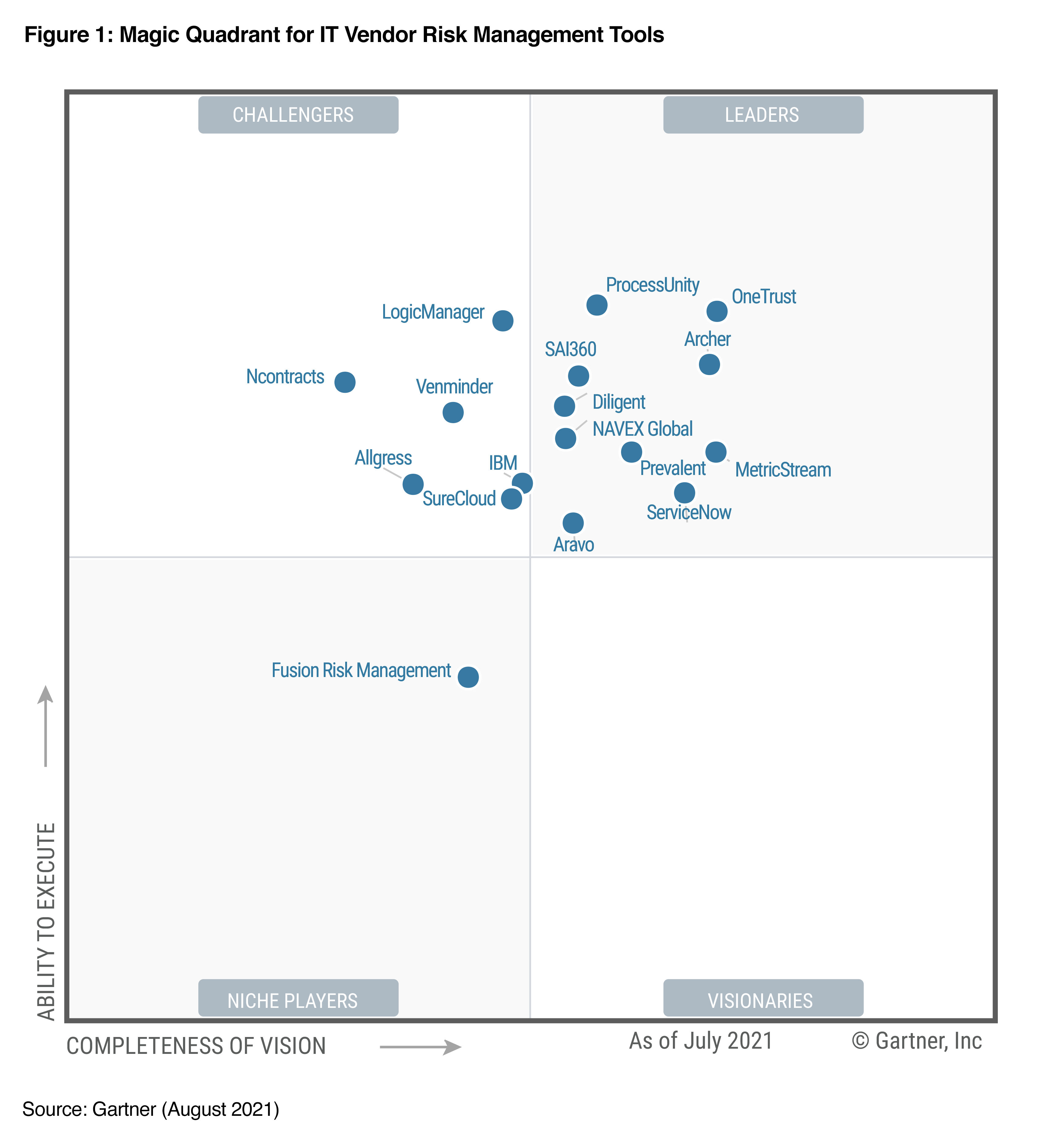

3. Identify automation providers

Consider your current and future needs, your automation goals, and your RPA roadmap. Be sure that the solution you choose is able to grow with your automation vision and business case. Select the partner that best fits your needs and don’t forget to be sure that their pricing models are aligned to your automation objectives. Learn about our automation solution, ACL Robotics.

4. Assess, plan, and share the results of your automation

Identify repetitive, manual, and simple processes. Start small—automate and assess the results. Once you’ve automated these smaller processes, share the results with management. Explain how, by rolling out more RPA, you can become even more efficient and maximize savings. Explain which processes you plan on automating next, and what you expect to gain. Once that next set of processes is automated, come back to management and share those results.

The greatest benefit of RPA may not be measurable in direct financial terms—at least not immediately—but more by the extent to which people are given opportunities for increased judgment and critical thinking. In time, freed resources will result in improved processes and productivity gains that are measurable and will clearly show the success of your RPA program.

Now you’re on the way toward robotic process automation. Find out how our RPA solution, ACL Robotics, can help you.

eBook

How data drives financial process governance

You’ll learn:

- What the world of a progressive finance leader looks like

- The top pressure points affecting today’s finance teams

- Steps to get started with a technology-driven approach to risk and control monitoring

- Examples of common, high-value, high-performing tests that can be applied in everyday finance process areas.